Why ‘golden’ passports and visas shouldn’t be abolished, but made better

2023/04/14 Leave a comment

Somewhat self-serving from one of the leading citizenship-by-investment companies:

Armand Arton has eight passports.

It’s a collection fitting for the CEO (or as Arton prefers, “Chief Global Citizen”) of a firm that helps ultra-wealthy people purchase second citizenships.

The passport business boomed during the pandemic, especially among wealthy Americans who, for perhaps the first time in their lives, were barred from entering many countries around the world.

Now, as Europe reckons with housing crises, inflation, extreme weather, and war, governments from Portugal to Ireland are banning foreigners from purchasing so-called golden passports and visas.

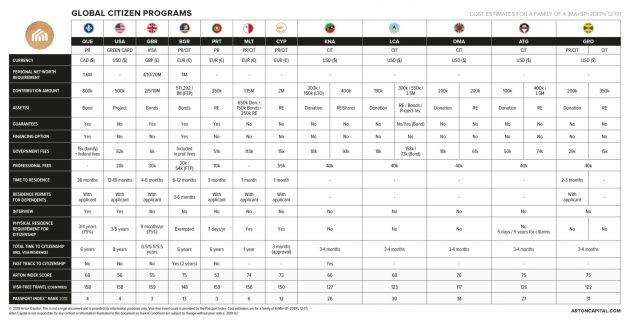

“Golden passports,” formally known as citizenship by investment programs, allow foreigners to receive citizenship in exchange for investing a certain amount of money in a country, often by purchasing real estate. Their less-advantageous siblings, “golden visas,” provide temporary residence permits in exchange for investment, as opposed to permanent citizenship.

Europe’s recent crusade against the programs boils down to a single question threatening the foundation of the $20 billion industry: is it fair to sell citizenship?

Arton thinks so — and not only because it pays his salary.

The CEO, whose firm has helped attract over $4 billion in foreign investment to various countries in the last 5 years, was born in communist Bulgaria after his family fled the Armenian genocide. When he drove with his parents through over a dozen countries to their new jobs in Morocco, he learned younger than most how your place of birth determines the degree to which you can move freely throughout the world.

“We had to go and apply for 14 visas, and convince 14 governments that were not refugees,” he said. “It makes you feel inferior and threatened everywhere you go, just because of the passport that you hold, which is not your choice.”

A lost financial opportunity

At the Carlyle hotel in Manhattan’s Upper East Side, the CEO wears a blue blazer and beaded rope bracelets, signifying that he is one of those wealthy people who is, or would like to be perceived as, down-to-earth. While Dr. Christian H. Kälin, the chairman of rival firm Henley & Partners goes by the nickname “passport king,” Arton tells me he thinks of himself as the “Robinhood of passports.”

“The rich will anyways get from point A to point B,” he says, beginning his pitch. “So removing the price they have to pay, it’s a lost financial opportunity.”

Instead of banning golden passports and visas outright, countries should adjust their investment requirements to match the current economic landscape and financial needs, he says.

In February, Portugal announced it will stop accepting new applications to its golden visa program as part of a package to help alleviate the housing crisis. Last year, approximately half of Portuguese workers made less than €1,000 per month, with many residents facing eviction.

But while blaming wealthy foreigners for rising housing costs is an easy political win, Arton says, the country would be better served if Portugal funneled the $7.4 billion in foreign investment brought in through the program since 2012 into projects that benefit local residents, like affordable housing or refugee services.

“Portugal should have stopped and said, listen, real estate doesn’t work for us anymore. Let’s find something else that the country needs,” he told Insider.

Dr. Kristin Surak, an Associate Professor of Political Sociology at the London School of Economics and author of “The Golden Passport: Global Mobility for Millionaires,” says that while firms like Arton’s obviously have a financial interest in the programs continuing, the founder does make some fair points.

According to Surak, there aren’t enough golden visa recipients to destabilize the entire country’s housing market. Since the program’s inception in 2012, Portugal has issued 11,628 investor visas, equating to approximately 0.1% of the national population.

“I think there’s a little bit of racism, to be quite honest, in terms of the way these programs get blamed for different things,” she said, noting that most foreign property owners in Portugal are from EU countries like France and Sweden. Meanwhile, Chinese and Brazilian nationals make up the majority of the country’s golden visa recipients.

A golden tax

In a country like Syria, home to the world’s largest refugee crisis, Arton has clients that pay hundreds of thousands to millions of dollars to purchase second citizenship and fly away on their private jets.

The stark contrast between the migration opportunities for the elite and the impoverished prompted Arton to advocate for a Global Citizen Tax, a 1% to 5% tax on all investor citizenship and residence applications to be put toward the nation’s most pressing needs.

“For me, it’s something that I really want to be able to make an impact on a larger scale, not only for the guys in first class and private jets,” he said.

A scandalous history

But golden passports don’t only raise the issue of inequality, the European Commission argues, they also pose a threat to national security. Following Russia’s invasion of Ukraine, sanctioned oligarchs were accused of using the schemes to dodge sanctions. And in 2020, an Al Jazeera investigation found that Cyprus’ now-defunct program sold citizenship to criminals and political fugitives.

Arton believes national security concerns may have been the motivation behind Ireland’s recent program closure, which happened right around the time of the Chinese spy balloon scare. Last year, 282 of Ireland’s 306 golden visa applications came from Chinese citizens, The Irish Timesreported.

Arton said due-diligence for vetting applicants could use improvement, and is in favor of increasing industry regulation and data-sharing between nations. However, he argues that the odds are much greater that so-called “unsavory actors” enter a country via undocumented routes.

“If I’m a terrorist, if I’m really somebody that wants to threaten the security of the European Union, the last thing I’m going to do is apply through one of these programs,” he said.

Surak said that, by the numbers, golden visas and passports are neither national security nor money laundering issues, and said in her experience, investor migration tends to invoke moral outrage among people who already have strong passports and have never had to think strategically about immigration.

“Migration is always somehow fundamentally economic,” she said. “I think it’s complicated, which is not to say there aren’t problems with the programs. But I think there’s also a lot of hypocrisy and that the inequalities and power dynamics aren’t exactly what one expects.”

Source: Why ‘golden’ passports and visas shouldn’t be abolished, but made better